| |

|

Long Term Care Insurance

|

|

Here's What You Need To Know!

To break it down to its simplest terms, Long Term Care Plans create a independent checkbook outside of your personal saving to pay for Extended Care costs. The simple reason to consider a plan is because the cost can be so great it will create a huge shortfall in your income stream. (Remember you don’t live on your assets you live on your income – a subtle but critical distinction.)

|

|

What is the best age to buy a Long-Term Care plan?

|

|

|

|

As soon as possible because there is no advantage in waiting. There could, however, be some drawbacks.

You become a higher risk as you age. This only means either higher premiums or ineligibility.

The annual cost of long-term care coverage at age 45 is about 20% of the cost of the same policy bought at age 65. The cost at age 65 is 35% of the cost of the same policy bought at age 75. Remember, the need for care can come at any age.

“What if I never need it?”

Denial is the best reason not to plan. And, honestly, we hope you live a long life … never have an accident or illness.

Yes, we hope you never need long-term care. We also hope you never have a car accident or a home fire. But hope is not a strategy. Planning for the future is. The stakes are just too high when its your family.

|

|

|

The following sections show in black and white the powerful leverage in action, and the reason why quick action is best for you.

Click Each Chart to View & Print In New Window

|

|

Leverage:

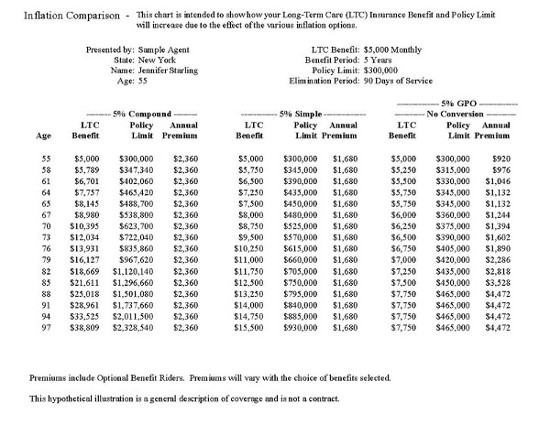

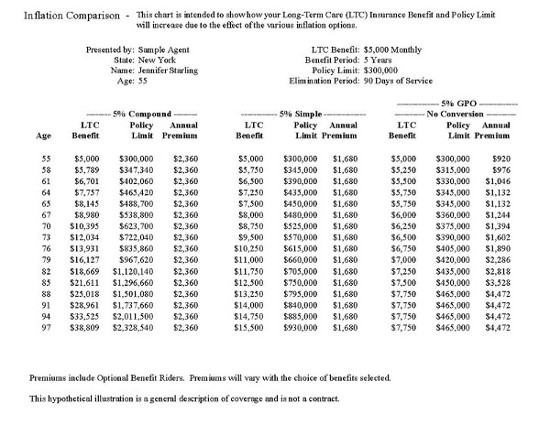

First lets go over the facts of this example:

- New York Case-Price can vary by state

- Jennifer is 55 Years old

- $5,000/Monthly benefit*Very important

- Plan will provide benefit continuously for 5 years

- Today this plan will fill your checkbook with $300,000

- The Elimination Period-Deductible 90 service days

Lets first look at the column on the right 5%GPO (Guarantee Purchase Option)-First Row

Where else can you deposit a check to your account for $920 (Annual Premium Amount) and if necessary leverage the available balance from that account to $300,000 (Policy Limit)

If you look at this quickly this option would seem to make the most sense,

But, Now lets consider the additional facts,

1-This illustration is for a person 55 years old- when are they most likely to need care now or @ 85 the average ???

2- Lets now look at the age line of 85 at the left

Please follow with me if we look at the 5% compound column (left)will now provide $21,611/monthly benefit- a total of almost $1,300,000 far surpassing the other examples.

Now tell me the best value if you needed care!!!

In a very few years the compound example will always provide the best value!!!

Get your personal illustration now

|

“The eighth wonder of the world is compound interest.”

- Albert Einstein -

|

|

|

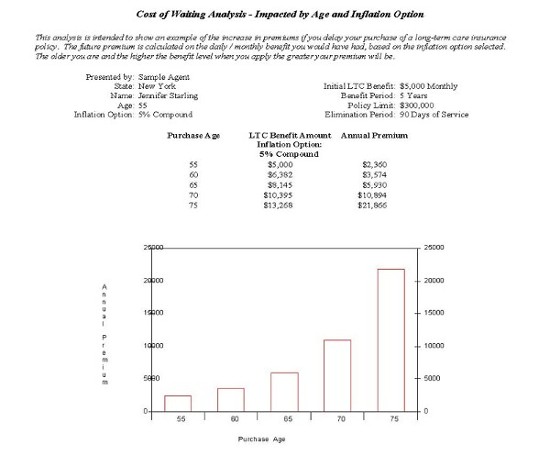

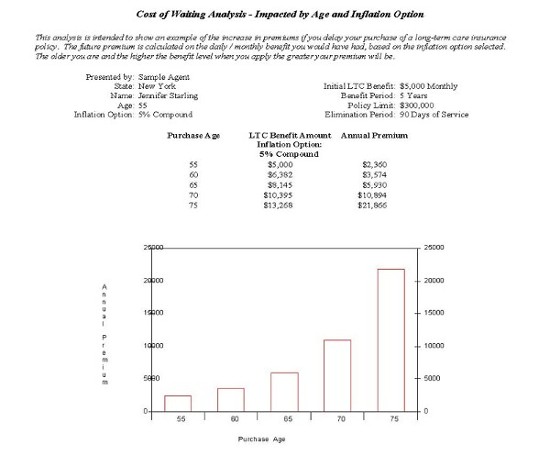

He who hesitates is lost:

Why action is needed now

Please consider the above chart

Same person as before look at all the additional dollars that are needlessly spent

|

Total Cost to 90 |

Additional Money Spent |

|

From (Age)

|

55

|

$82,600

|

|

|

|

60

|

$113,222

|

$30,562 |

|

65

|

$148,250

|

$65,650 |

|

70

|

$217,880

|

$135,280 |

|

75

|

$327,990

|

$245,390 |

Yes you can recoup some of those dollars if you invest the unspent premiums but if your health should ever change the window of opportunity to buy is forever lost.

|

|

|

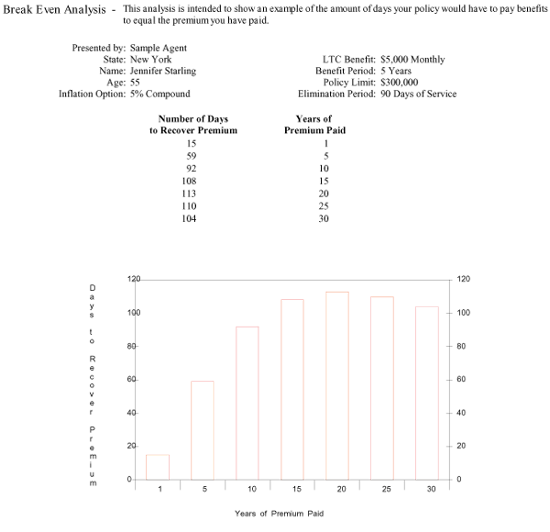

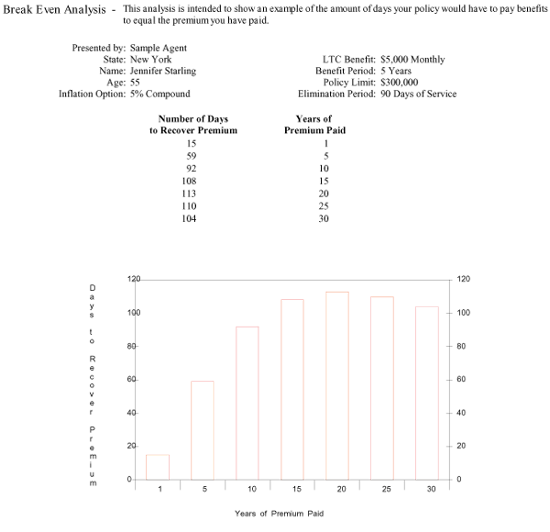

Again we will use Jennifer as an example.

The above the chart shows how quickly you will recoup premiums paid.

If you pay the premiums for 30 years in 104 days you will have utilized the equivalent all dollars spent on premiums.

We can do a custom break even cost analysis using any combination of interest rates, costs and benefits

Click here for your personal analysis

|

|

| Age of Applicant |

Average Declined Coverage |

| Under 50 |

7.3% |

| 50 to 59 |

13.9% |

| 60 to 69 |

22.9% |

| 70 to 79 |

44.8% |

| 80 and over |

69.8% |

Source American Association for Long Term Care Insurance 2009

|

|

One of the most misunderstood aspects of getting coverage is the timing when to purchase. Unfortunately you need you get your plan before your health changes.

(This will remain independent of any new legislation regarding healthcare.)

|

For those with health problems, the big question is, can they get coverage?

The only way to answer the question, however, is to have them apply.

Small Sample of Uninsurable Conditions:

Alzheimer's, Dementia, memory loss, Multiple Sclerosis, Parkinson's, degenerative nerve diseases, AIDS, cirrhosis of the liver, congestive heart failure, dialysis, osteoporosis (with a history of multiple falls or fractures),cancer that has spread, emphysema, inability to perform your own activities of daily living, use of a walker or wheelchair, Muscular Dystrophy, Neuropathy (due to diabetes, alcoholism or polio), organ transplant, schizophrenia, renal insufficiency or failure, tremors, severe osteoarthritis or rheumatoid arthritis, severe chronic pulmonary disease, and cerebral palsy.

(If you feel that you might be uninsurable please click here and we can discuss other possibilities)

|

How Much Coverage Do You Need?

Typically the benefit amount offered is $100-$500/Day or $3000-$15,000/Month

And you can choose different amounts for care in a facility or care in your own home.

These calculations are where most people totally miss the boat and get it wrong.

The reason for that is most advisors who offer LTCI really don’t know the right answers themselves.

Call for your consultation and the 1 minute explanation so you get it right.

Click here for your consultation

|

Conclusion

With improved longevity there is in all likelihood a growing need for long-term care services by aging baby boomers in the next few decades. The costs will be immense. It is unlikely that our society can meet that demand, given the present mix of long-term care funding, which relies primarily on the use of out-of-pocket resources or if no personal funds are available public welfare. Because insurance is the best method to protect against this type of risk the best solution would be to start as early as possible when the total costs would be the least out of pocket overall.

|

ARE THERE ANY DISCOUNTS AVAILABLE?

Partner Discount 15-40%

We currently work with over 300 national groups and can directly offer those group discounts.

Please see if I qualify for those groups

|

Several Points To Ponder:

The government isn't going to pay for long term care at home, in a nursing home, or in an assisted living center.

Medicare pays 100% of long term care for 20 days and all but a deductible for the next 80 days—after that nothing. Medicare is designed to pay for skilled care and most part long term care is not skilled care.

A Harvard University study showed that 69% of single people and 34% of married couples would exhaust their assets after 13 weeks in a nursing home. 13 Weeks = 91 days! (This person should not buy LTCI anyway.)

At age 65, a woman has a 1 out of 2 chance of spending some time in a nursing home. A man has a 1 out of 3 chance.

Medicaid kicks in only after a person's assets and dignity are gone.

After all, Medicaid is WELFARE.

Children would like to help, but children often have kids of their own. They certainly can't quit their jobs to care for their parents.

Health rarely improves with age. Buying early not only locks in rates which you could not receive at a later date, but ensures you are covered.

You can't buy long term care coverage at crisis time.

American's have access to the best health care in the world, if they can pay for it.

Most people want to choose where they go instead of having to go where they are taken, and if independence is important then you need to think ahead.

Take the next step and put your worries to rest—today.

Please set up my consultation Click Here

|

|

|

|